When a loved one passes away, the last thing you need is financial stress piling on top of your grief. Yet, many families find themselves in exactly that situation, staring at funeral costs they simply cannot afford.

Thousands of people each year struggle to cover the rising costs of burial or cremation, and it’s a problem that isn't often talked about. However, there are resources, programs, and practical steps that can help you overcome this challenging time without sinking into debt. Whether it’s seeking government assistance, considering alternative funeral arrangements, or understanding legal obligations, you need real answers.

In this guide, we’ll break down exactly what happens when you can’t afford a funeral, what choices you have, and how to handle this situation with dignity and clarity.

Average Funeral Costs in the U.S.

Funerals in the U.S. are expensive, often shockingly so. Most people don’t realize just how much a traditional funeral can cost until they’re faced with planning one. That’s why understanding the costs upfront is so important

Right now, the average cost of a funeral in the United States sits between $7,000 and $12,000. That number includes basics like the funeral home services, the casket, and the burial plot, but the final bill depends on a variety of factors, including location, the funeral provider, and the level of service chosen.

It means that if you don’t already have a financial plan in place for a funeral, whether for yourself or a loved one, you could be looking at an unexpected five-figure expense.

What Happens If You Can’t Afford a Funeral?

If you can’t afford a funeral, the situation can quickly become unmanageable. When a loved one passes and there’s no money available, what happens next depends on several factors: who’s legally responsible, whether the deceased had any assets, and how the local government handles cases like this. It’s a tough subject, but let’s break it down so you know what happens when financial hardship meets the unavoidable reality of death.

Who is Legally Responsible for Funeral Costs?

Legally, the responsibility for paying funeral costs typically falls to the deceased’s estate first. If they had savings, investments, or assets, those funds are supposed to cover the expenses before being distributed to any beneficiaries. But when there’s little to no money left behind, things get more complicated. If the deceased had a surviving spouse or children, in many cases, they are expected to handle the arrangements. Some states have filial responsibility laws, meaning children can be legally obligated to pay for their parent’s funeral if no other funds exist. However, if there’s no money and no willing or able family members, the government steps in, but that doesn’t mean a traditional funeral will happen.

What Happens When There’s No Money and No Family?

When a person dies with no financial resources and no next of kin willing to pay, the state or county takes over. The process varies depending on the location, but in most cases, the body will either be buried in a common grave or cremated through a government-funded indigent burial program. These are sometimes referred to as “pauper’s funerals,” a term dating back centuries to describe burials for those who couldn’t afford their own.

Each state and county has different rules about how they handle unclaimed bodies. Some local governments provide a basic burial service, while others strictly offer cremation as the only option. The remains may be stored for a short period in case a family member comes forward, but if no one does, the ashes might be scattered in a designated area or buried in a mass grave. There’s usually no headstone or personal marker, just a registry documenting who was laid to rest there.

In some areas, the county will attempt to contact family members or estate representatives before proceeding with a government-funded burial. If they discover a relative who is legally obligated but unwilling to pay, courts can sometimes take action, although this is rare. More often than not, if no one claims the body and no money exists, the state moves forward with the most cost-effective solution.

What Happens to the Body If No One Pays for a Funeral?

If no one steps forward to cover the costs, the body will eventually be handled by the county’s burial or cremation program. In most cases, direct cremation is the go-to method because it’s the least expensive option. The ashes may be stored temporarily in case a family member claims them, but if that doesn’t happen, they are often buried in an unmarked communal grave or respectfully scattered by the county.

Another alternative some people turn to is a whole-body donation. Universities and medical research institutions accept donated bodies for educational and scientific purposes. If a person chooses this path in advance or if their next of kin makes the decision, the donation process typically covers all expenses, including cremation after studies are complete; a practical and meaningful option for those without financial resources to plan a funeral, yet wishing for their death to contribute to medical advancements.

Financial Assistance & Low-Cost Funeral Options

When the cost of a funeral is simply beyond reach, many families feel trapped between grief and financial strain. But even in the most difficult situations, options exist. So, let’s break them down:

Government & State Assistance Programs

If financial limitations make paying for a funeral impossible, the first place to check is government assistance. Social Security offers a small but useful death benefit - $255 to help a surviving spouse or child cover part of the funeral costs. Yes, it’s not a solution on its own, but it can contribute to a broader plan for covering expenses.

Medicaid and state welfare programs can also step in for those who qualify. Certain states provide burial assistance, sometimes in the form of direct financial help or by covering the cost of cremation or a basic burial. The challenge is that these programs aren’t always well-advertised, meaning many families don’t even know they exist. Contacting local social services or a funeral home experienced in assisting low-income families can help uncover available resources.

For veterans, the Department of Veterans Affairs (VA) offers burial benefits that can significantly ease the financial strain. If the deceased was a veteran, their family may be entitled to a burial allowance, a free gravesite in a national cemetery, or even reimbursement for certain funeral expenses. The VA also provides headstones, markers, or medallions at no cost.

Non-Profit & Religious Organizations Offering Aid

Many non-profit organizations exist solely to help families facing financial struggles with funeral costs. These groups may cover cremation costs, provide grants, or negotiate discounted services with funeral homes. It takes some research to find the right fit, but organizations like the Funeral Consumers Alliance and local assistance groups are good places to start.

Religious institutions have long played a role in easing funeral expenses for their members. Some churches, mosques, synagogues, and temples offer free or low-cost funeral services, often including the use of a venue for a memorial service. Clergy members may waive their fees, and religious communities often rally around grieving families to provide financial support. If the deceased was actively involved in a religious organization, reaching out to the leadership can open doors to assistance that may not be widely advertised.

Crowdfunding & Community Support

When traditional financial assistance isn’t enough, families are turning to crowdfunding. Platforms like GoFundMe have become a lifeline for those who can’t afford a funeral, allowing friends, family, and even strangers to contribute. A well-crafted fundraising campaign that tells the deceased’s story and explains the financial need can quickly gain traction, sometimes raising thousands of dollars in just a few days.

Beyond online fundraising, local communities often step in when a family is struggling. Churches, social groups, and even small businesses sometimes organize donation drives to help with funeral expenses. It’s not uncommon for communities to host benefit dinners, raffles, or silent auctions, with proceeds going directly to the grieving family. People want to help, but they need to know there’s a need, so reaching out and asking for support can make all the difference.

Some people also wonder, can life insurance pay for funeral costs? The answer is yes, if the deceased had an active life insurance policy, the payout can be used to cover any funeral-related expenses. Some policies even allow an advance to be taken out before the full claim is processed, which can be a crucial relief for families struggling with immediate costs.

Another common concern is, are funeral expenses tax deductible? In most cases, individuals cannot deduct funeral expenses from personal income taxes. However, if the funeral costs are paid out of an estate, they might be deductible as an estate expense, depending on the circumstances. Consulting a tax professional can provide clarity on whether any deductions apply.

Affordable Funeral Alternatives

As already said, a standard funeral with burial can easily cost between $7,000 and $12,000 or more, depending on location and service choices. When funds are tight, it’s really important to explore alternatives that provide respect without a crushing financial toll.

Direct Cremation

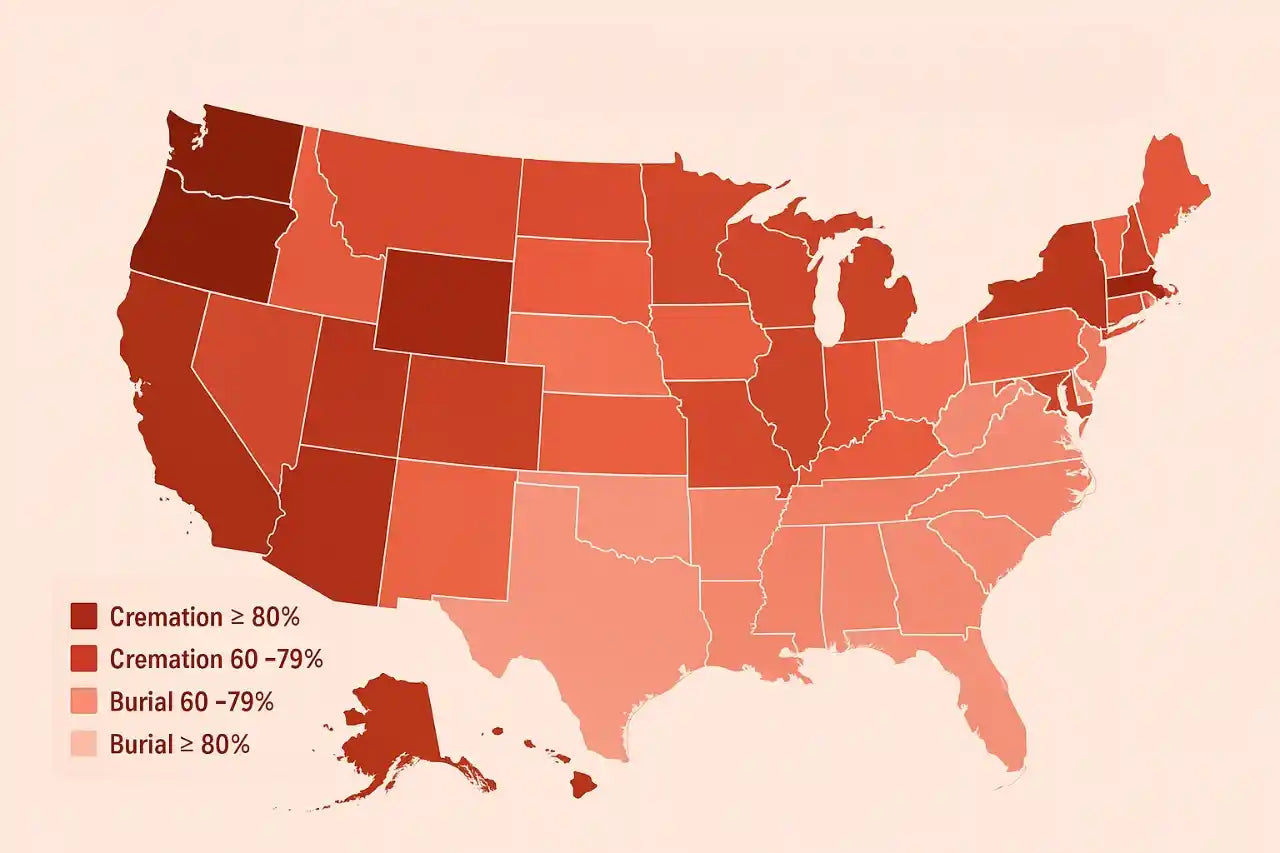

If there’s one option that consistently stands out as the most budget-friendly, it’s direct cremation. Unlike a traditional funeral that involves embalming, a viewing, a casket, and burial, direct cremation eliminates most of these expenses. The body is collected, cremated shortly after death, and the ashes are returned to the family, without the need for a service at the funeral home.

When you compare costs, the numbers are eye-opening. A traditional burial with a casket, embalming, and funeral service can set you back more than $10,000. A direct cremation, on the other hand, typically costs between $500 and $2,500, depending on the provider and location. That’s a fraction of the price, and it leaves families with the flexibility to hold a memorial on their own terms.

The process itself is straightforward. Once a death occurs, the cremation provider takes care of transportation, paperwork, and the actual cremation. There’s no need for a costly coffin, embalming, or an expensive gravesite. Many families appreciate the simplicity of this option; it removes financial stress while still allowing for personal and meaningful ways to say goodbye.

Green Burials & Eco-Friendly Options

For those who want an alternative to both traditional burials and cremation, green burials offer a more natural and affordable solution. Conventional funerals involve chemical embalming, metal caskets, and concrete vaults, all of which add to the cost. Green burials strip everything down to the basics: no embalming, no concrete vaults, no metal-laden caskets. Instead, the body is placed in a biodegradable shroud or a simple wooden or wicker casket and buried in a way that allows for natural decomposition.

A green burial typically falls in the range of $2,000 to $5,000. Some cemeteries specifically cater to green burials, offering natural landscapes without the excessive maintenance costs of a conventional cemetery. Families can also explore burial options on private land, which can further cut expenses if local laws permit it.

Another advantage? Green burials are environmentally friendly. Many people are drawn to the idea of returning to the earth naturally rather than having their bodies preserved with chemicals. For those who care about sustainability, it’s an option that makes both financial and ethical sense.

Home Funerals & DIY Memorial Services

The idea of handling a funeral without a funeral home may seem challenging, but it’s entirely possible, and, in many cases, completely legal. Home funerals involve family members taking responsibility for after-death care, preparation of the body, and hosting a memorial service in a private setting rather than at a funeral home.

The legalities vary by state or country, but in most places, families have the right to care for their own dead. The key is understanding the paperwork requirements, such as obtaining a death certificate and securing necessary permits for burial or cremation. Some states require the involvement of a funeral director at certain points, but many do not.

A home funeral allows for complete control over how a loved one is honored. The body can be kept at home for a wake, prepared for burial with natural methods, and even transported to the burial site without the need for professional services.

Whole-Body Donation to Science

For those who want to contribute to medical advancement while also avoiding funeral costs, whole-body donation is a great option. Many organizations accept body donations for research, education, and training medical professionals. In return, they typically cover the costs of transportation, cremation, and the return of ashes to the family. This means a family pays nothing out of pocket.

Programs like Science Care, United Tissue Network, and various university medical schools operate donation programs that help advance scientific knowledge while providing a no-cost alternative to traditional funerals. After the donation process is complete, the organization cremates the body and returns the ashes to the family, often within a few weeks or months.

One common concern is whether body donation will conflict with religious beliefs. Some religions prohibit it, but many do not. In fact, some faiths view donation as a final act of charity.

It’s important to pre-register for body donation whenever possible, as some programs have specific criteria regarding medical conditions, age, and cause of death. That said, even if a loved one has passed unexpectedly, many donation organizations accept last-minute inquiries from next of kin.

Can I Get a Loan to Cover Funeral Expenses?

Yes, you can take out a personal loan to cover funeral costs, but whether it’s the best option depends on your financial situation. Banks, credit unions, and online lenders offer funeral loans, typically unsecured, meaning you don’t need collateral. However, interest rates can be high, especially if your credit score isn’t great. Some funeral homes offer financing plans, but read the fine print; hidden fees can add up.

Another option is a credit card, though this should be a last resort due to interest accumulation. If you're struggling financially, consider crowdfunding, government assistance, or nonprofit programs. A loan might give you immediate relief, but make sure you’re not creating a long-term financial problem you’ll regret.

What if I Refuse to Pay for a Relative’s Funeral?

In most cases, you’re not legally required to pay for a relative’s funeral unless you signed a contract with a funeral home or were financially responsible for them while they were alive. If no one steps up, the local government or coroner’s office will handle arrangements, usually opting for a simple burial or cremation. However, if you were the next of kin and had control over their assets, the state may expect funeral costs to come from their estate. If you flat-out refuse and no estate exists, the responsibility shifts to public assistance programs, meaning a modest, no-frills service. It’s a tough situation, but the law generally won’t force you to foot the bill if you don’t want to.

Can You Negotiate Funeral Costs?

Absolutely. Funeral costs aren’t set in stone, and many expenses are optional. Funeral homes often push expensive packages, but you have the right to pick and choose what you actually need. The Federal Trade Commission (FTC) requires funeral homes to provide an itemized price list, so don’t hesitate to ask for one.

Compare prices between providers and ask about lower-cost options. Direct cremation or immediate burial can significantly reduce costs. You can also provide your own urn or casket instead of buying from the funeral home, which typically marks up prices. Many people don’t realize they can negotiate, but the reality is that funeral homes are businesses, and like any business, they want paying customers.