Funerals aren’t cheap. The average cost of a funeral today can easily climb past $10,000 when you consider everything: burial or cremation, a casket or urn, service fees, and even the smallest details like flowers and obituary notices. It’s a financial challenge most families aren’t prepared for, and that’s exactly where life insurance is supposed to help. But does it cover funeral expenses?

The short answer is yes, but it depends on the type of policy you have, the payout process, and how the beneficiaries choose to use the funds. Some policies are designed specifically to cover end-of-life costs, while others provide a lump sum that your loved ones can allocate however they see fit. However, not all policies pay out quickly, and if you don’t have the right setup, your family could still face unexpected out-of-pocket costs.

In this article, we’ll break down everything you need to know about using life insurance for funeral expenses. We’ll cover which policies work best, how to ensure a smooth payout and potential pitfalls to avoid. If your goal is to protect your family from financial stress after you're gone, you need the right plan in place. Don’t leave it to chance; let’s dive in and make sure you're covered.

How Much Does a Funeral Cost?

Funeral costs can be shockingly high, frequently leaving families unprepared during an already difficult time. On average, a traditional funeral in the U.S. ranges from $7,000 to $12,000, but that number can climb much higher depending on location, personal preferences, and the type of service chosen.

Breaking down these costs, the funeral home services alone typically account for a significant portion of the total bill, including everything from the basic service fee, which covers administrative work and coordination, to embalming, body preparation, and transportation. A viewing and funeral service will add to the total, especially if it involves renting a facility and hiring staff.

The burial itself is another major expense. A burial plot in a cemetery can cost anywhere from a few hundred dollars in rural areas to well over $10,000 in major cities. Then there's the casket; arguably one of the most expensive single items in the entire process. While a simple casket may be available for a couple of thousand dollars, higher-end models with premium materials and elaborate designs can easily exceed $10,000.

One cost that often surprises families is the headstone cost. A simple flat marker may start at a few hundred dollars, but more complex headstones, custom engravings, and premium materials can push that price into the thousands. Many families don’t anticipate these costs in advance, and when combined with cemetery fees for opening and closing the grave, perpetual care, and administrative fees, the total continues to grow.

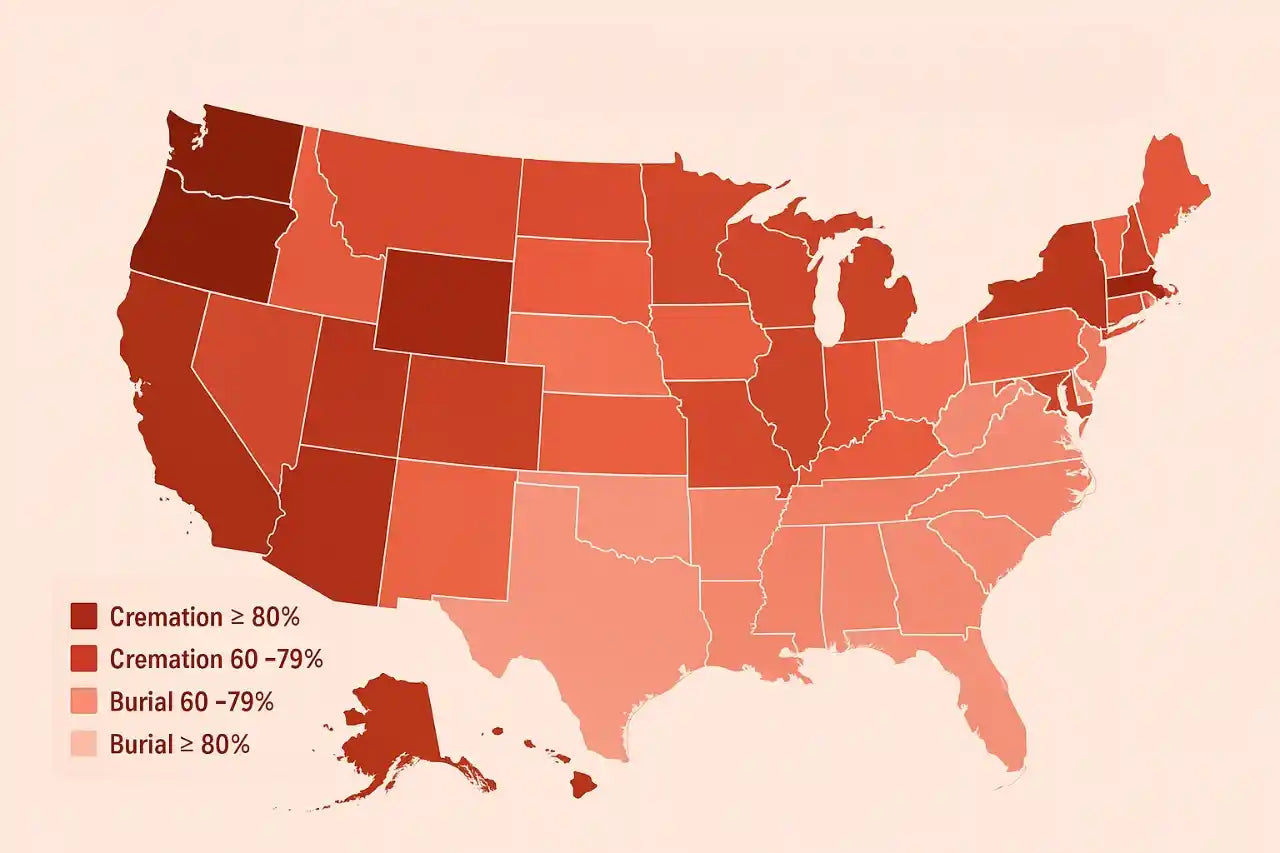

For those opting for cremation, the costs are typically lower, but they can still add up depending on what’s included. A direct cremation, which skips the formal service and viewing, may cost as little as $1,000 to $2,500. However, adding memorial services, urns, and specialized cremation caskets can bring that number much closer to the cost of a burial.

Beyond these core expenses, there are plenty of unnecessary funeral expenses that families often feel pressured to pay for. Upselling is common in the funeral industry, with services like premium obituary placements, high-end floral arrangements, memorial keepsakes, and limousine rentals marketed as essential when they’re not. Funeral directors may offer elaborate packages that include items families don’t necessarily need, leading to significantly higher costs.

When planning a funeral, it’s crucial to distinguish between what’s truly necessary and what’s simply tradition or sales pressure. Many families regret overspending during an emotional time, especially when they realize more affordable alternatives exist. Pre-planning, comparing prices, and knowing what to expect in advance can help avoid financial strain while still honoring a loved one with dignity and respect.

How Life Insurance Works in Covering Funeral Costs

Life insurance is one of the most reliable ways to make sure that funeral costs don’t become a financial headache for your loved ones. When the policyholder passes away, the insurance company issues a payout, known as the death benefit to the named beneficiaries. This is a tax-free lump sum, and while there are no restrictions on how it’s used, it’s commonly relied upon to cover immediate expenses, including funeral costs, outstanding medical bills, and any remaining debts.

The moment a death occurs, beneficiaries must file a claim with the insurance provider, submitting necessary documents like the death certificate and policy details. Once the claim is verified, the payout is processed, but the timeline isn’t always instant. Most insurance companies release funds within two weeks to a month, though it can take longer if there are disputes, missing documents, or additional investigations, especially in cases where the death occurs within the policy’s contestability period (typically the first two years of coverage).

This waiting period is something families need to prepare for, particularly if funeral homes require immediate payment. Since life insurance payouts aren’t sent directly to funeral service providers, it falls on the beneficiaries to manage the funds. Some families choose to cover funeral costs upfront; either through personal savings or financing options, while waiting for the insurance payout to arrive.

Others plan ahead by securing pre-paid funeral arrangements or funeral insurance, which is a separate policy designed specifically to handle these expenses without delay.

The power of a life insurance policy ultimately rests in the hands of the named beneficiaries. They have complete control over how the money is allocated. If the policyholder intended for the payout to cover funeral costs, they must have chosen responsible beneficiaries who will honor those wishes. Otherwise, the funds could be used for anything: mortgage payments, debt settlement, or even personal expenses, leaving funeral bills unpaid.

That is why financial planning conversations are very important. Policyholders should clearly communicate their expectations with beneficiaries to prevent misunderstandings, making sure that life insurance serves its intended purpose when the time comes.

However, the process isn’t as straightforward as some might assume. There’s a waiting period, the responsibility falls on the beneficiaries, and if the claim gets delayed, families might need an alternative payment solution in the short term.

Types of Life Insurance That Cover Funeral Costs

As said, life insurance is one of the most effective ways to ensure your funeral costs are covered, but not all policies work the same way. So, it’s very important to understand the different types of life insurance that you can use for funeral expenses, as each option comes with its advantages, limitations, and suitability depending on your financial situation, age, and long-term planning goals. Let’s break down the key options available.

Term Life Insurance

Term life insurance is one of the most commonly purchased types of life insurance, mainly because it provides a high coverage amount for a relatively low cost. The way it works is straightforward: the policyholder chooses a term; typically 10, 20, or 30 years, and pays a fixed premium throughout that period. If they pass away within that timeframe, the insurer pays out the full death benefit to the designated beneficiaries. If the policyholder outlives the term, however, the coverage simply expires with no payout.

So, does term life insurance cover funeral costs? Yes, but only if the policyholder dies while the policy is still active. The funds from a term life insurance policy can be used for anything, including funeral and burial expenses, but since the payout isn’t guaranteed (because the policy may expire before death occurs), it’s not always the most reliable solution for end-of-life planning. Many people purchase term life insurance when they have dependents, using it as income replacement in case of an untimely death, but they later transition to other types of policies for funeral coverage as they age.

The main advantage of using term life insurance for funeral costs is its affordability. You can secure a large amount of coverage, sometimes in the range of hundreds of thousands or even millions of dollars, for a relatively low premium, making it a cost-effective way to provide financial security for your family.

However, the downside is that if you outlive the term, the policy expires, leaving you without any coverage for funeral expenses unless you opt to renew or convert it to a permanent policy, which may come with significantly higher premiums.

Whole Life Insurance

Whole life insurance is a permanent form of coverage that lasts for your entire lifetime as long as you continue paying the premiums. Unlike term policies, which expire, whole life insurance guarantees a payout whenever you pass away, whether that’s at age 50, 70, or 100. This makes it a highly reliable choice for covering funeral expenses since there’s no risk of the policy lapsing due to reaching a specific time limit.

Another significant feature of whole life insurance is its cash value component. Part of your premium payments go into a savings-like account that accumulates over time, allowing you to borrow against it or even withdraw funds if needed. This can provide additional financial flexibility if you ever need emergency funds, but it’s important to remember that borrowing against the policy reduces the eventual death benefit unless the loan is repaid.

Using whole life insurance for funeral costs is a safe bet. Since the policy never expires, your beneficiaries are guaranteed to receive a payout, which they can use to cover all end-of-life expenses, from burial or cremation to memorial services and outstanding medical bills. The drawback, however, is that whole life insurance tends to be significantly more expensive than term life insurance. Premiums are higher, and because these policies build cash value, they may not be the most efficient option if your only concern is covering funeral costs.

Final Expense (Burial) Insurance

Final expense insurance, also known as burial insurance, is specifically designed to cover end-of-life expenses, including funeral costs, medical bills, and even small debts. Unlike standard term or whole life insurance, final expense policies typically have much lower coverage amounts, ranging from $5,000 to $25,000 because they are meant to cover immediate expenses rather than provide long-term financial security for dependents.

The biggest appeal of final expense insurance is its accessibility. Many seniors or individuals with health conditions who might struggle to qualify for traditional life insurance find final expense policies easier to obtain. These policies often have simplified underwriting, meaning they don’t require a medical exam and have lenient approval criteria. Some even offer guaranteed acceptance, though these typically come with a waiting period before full benefits are available.

Since final expense insurance is specifically tailored for funeral planning, it’s a practical solution for those who don’t need large coverage amounts but want to ensure their family isn’t burdened with out-of-pocket costs. The downside? Because of the lower coverage limits, the cost per dollar of coverage is often higher compared to term or whole-life policies. Still, for those seeking a dedicated funeral fund with straightforward approval, it’s a reliable choice.

Prepaid Funeral Plans vs. Life Insurance

Life insurance is a common method of covering funeral expenses, but some people choose an alternative route: prepaid funeral plans. These plans allow individuals to pay for their funeral arrangements in advance, locking in today’s prices for services that may be used years or decades later. Funeral homes typically offer these plans, letting customers pre-select everything from caskets and burial plots to cremation services and memorial arrangements.

The main difference between prepaid funeral plans and life insurance is flexibility. With a life insurance policy, your beneficiaries receive a lump sum payout, which can be used however they see fit giving them the ability to cover funeral costs while also handling other financial obligations like medical bills, debts, or living expenses.

In contrast, prepaid funeral plans are limited to funeral-related costs and are typically non-transferable, meaning the money can only be used at the specific funeral home where the arrangements were made.

One of the biggest risks with prepaid funeral plans is that they are tied to the business providing the service. If that funeral home goes out of business, your money could be lost, whereas life insurance is backed by major financial institutions with strong consumer protections. Additionally, prepaid plans don’t provide any extra funds beyond funeral costs, so if you want to leave money behind for your family, life insurance is a more comprehensive option.

However, prepaid plans do offer one key benefit: they eliminate the stress of funeral planning for loved ones. Since all arrangements are made in advance, there’s no guesswork involved, and family members don’t have to make difficult financial decisions during an emotionally challenging time.

Factors That May Affect Funeral Cost Coverage

A policyholder’s family may expect a seamless payout to handle funeral costs, but several factors can complicate or even delay the process. One of the biggest challenges is the processing time for life insurance claims. Many assume that once a loved one passes away, the money will be available almost immediately to cover funeral expenses. That’s rarely the case. Insurance companies have procedures to verify the claim, confirm the policyholder’s cause of death, and make sure all required documentation is in order.

The process can take anywhere from a few weeks to several months, depending on the complexity of the case. Some insurers offer expedited benefits for funeral expenses, but not all policies include this option. If the payout is delayed, families may have to front the cost of burial, cremation, or memorial services before ever seeing a dime from the insurance company.

Another roadblock comes in the form of outstanding debts or liens on the policy. In some cases, creditors may have legal claims against the life insurance payout.

For example, if the deceased had unpaid taxes or court-ordered child support obligations, a portion or in extreme cases, the entirety of the death benefit could be redirected before the family sees a single cent.

The contestability period is another factor that can leave beneficiaries uncertain. Most life insurance policies include a clause that allows the insurer to investigate any death that occurs within the first two years of the policy being active. During this time, if the insurance company finds discrepancies, misstatements, or omissions in the original application, such as undisclosed medical conditions or risky lifestyle choices, the claim can be delayed, reduced, or outright denied.

Some people assume that once a policy is signed and active, the payout is guaranteed. In reality, insurers scrutinize early claims closely, looking for any reason to reject or contest them.

Exclusions written into the policy can also derail funeral cost coverage, and many beneficiaries don’t realize this until it’s too late. Suicide clauses, fraud suspicions, and non-disclosure of health conditions are some of the most common reasons an insurance company may refuse to pay out a claim. If the policyholder dies by suicide within a specified period (usually two years), the insurer may deny the claim entirely, returning only the premiums paid.

Fraud is another major red flag. If the policyholder provided false information on their application, whether intentional or accidental, the claim can be denied, even if the falsehood had nothing to do with their cause of death. For example, if someone failed to disclose a pre-existing medical condition, even if it wasn’t related to their passing, the insurer could argue that the policy was issued under pretenses and refuse to pay.

All of this means that while life insurance can cover funeral costs, it’s not always a straightforward process. Delays, financial obligations, and contractual loopholes can all create roadblocks that leave families struggling to pay for final arrangements out of pocket. It’s crucial for policyholders and their beneficiaries to understand these potential issues long before a claim is ever filed because, by the time the funeral home is expecting payment, it's already too late to fix the problem.

Alternatives to Life Insurance for Funeral Expenses

Sometimes life insurance isn't the best or most practical option. Life insurance policies can take weeks or even months to pay out, leaving families to front the costs in the meantime. Some policies come with restrictions, exclusions, or unexpected complications that could delay or reduce the payout. That’s why many people look for alternative ways to make sure their loved ones aren’t left with thousands of dollars in unexpected expenses. Whether through personal savings, designated accounts, government aid, or even community fundraising, there are multiple ways to prepare for funeral expenses without depending on life insurance.

Savings Accounts

One of the most straightforward alternatives is a personal savings account dedicated to funeral costs. It gives you full control over the money, making sure it’s readily available when needed. Unlike life insurance, which requires paperwork and a claims process, savings accounts provide immediate access to funds. If a loved one needs to cover expenses quickly, they can withdraw the money without waiting for an insurer’s approval.

However, simply saving money in a regular bank account comes with a few risks. If the funds aren’t explicitly set aside or earmarked for funeral costs, they might get used for other expenses, either intentionally or accidentally. A more structured way to handle this is by opening a high-yield savings account specifically for funeral planning.

The main downside of relying solely on savings is that it requires discipline and time. If death occurs unexpectedly, there may not be enough set aside to cover all costs. Additionally, inflation can drive up funeral expenses over time, meaning what seems like enough today may not be sufficient years down the road. Still, for those who prefer flexibility and control, a dedicated savings account remains one of the simplest and most effective alternatives to life insurance.

Payable-on-Death (POD) Accounts

A Payable-on-Death (POD) account is a more structured approach to saving for funeral costs while ensuring that funds go directly to the intended beneficiary without legal complications. A POD account functions just like a regular savings or checking account, but with a key difference: the owner designates a beneficiary who will automatically receive the funds upon their passing. Such an arrangement bypasses probate, the often lengthy legal process of distributing assets, allowing immediate access to the money when it’s needed most.

Setting up a POD account is simple. You work with a bank or credit union to designate a beneficiary, who then gains full access to the funds upon your death. The advantage here is that the money remains yours while you're alive; no one else can access or use it prematurely. Unlike a traditional will, which can be contested and tied up in court, a POD account ensures the funds go directly to the designated person with minimal delays.

One limitation of this alternative is that if there isn’t enough money in the account at the time of death, the beneficiary may still need to find other sources to cover the remaining funeral costs. Additionally, because it functions like a savings account, the money isn’t locked in for funeral expenses specifically. So, technically you can not use it for anything. That means it’s up to the beneficiary to follow through on your wishes. Still, a POD account offers a seamless and legally protected way to pass on funds for funeral expenses while avoiding the red tape of insurance claims or probate court.

Government Assistance Programs

For those without significant savings or life insurance, government assistance programs can help cover funeral costs, although the level of support varies depending on location and financial situation. In the United States, for example, the Social Security Administration provides a small lump sum death benefit of $255 to surviving spouses or eligible dependents. Actually, this amount is nowhere near the full cost of a funeral, but it can help offset some immediate expenses.

Medicaid recipients may qualify for funeral assistance in certain states, with some offering direct financial aid or burial programs that cover basic costs. State and local government programs also exist to help low-income families afford funerals. These programs are often need-based, meaning eligibility is determined by financial status, and the assistance provided may be minimal compared to the actual expenses.

In cases of unexpected or tragic deaths, such as homicides, some states have victim compensation programs that contribute toward funeral and burial costs. Similarly, military veterans may receive burial benefits through the Department of Veterans Affairs, including reimbursement for funeral expenses, burial plots, or even a free burial in a national cemetery.

The biggest challenge with government assistance is that it rarely covers the full cost of a funeral. Many programs are income-based, meaning middle-class families might not qualify. Even those who do qualify often receive funds only after the funeral has taken place, which can create financial strain for those handling the immediate costs.

Crowdfunding and Community Support

In recent years, crowdfunding has become a vital resource for covering funeral expenses, particularly for families caught off guard by unexpected deaths. Platforms like GoFundMe, Kickstarter, and even social media-based fundraisers allow friends, family, and the community to contribute financially, often raising significant amounts in a short period.

The success of a crowdfunding campaign largely depends on community support. A compelling story, a strong social network, and a well-organized campaign can lead to substantial donations. However, relying on crowdfunding comes with risks. There’s no guarantee that a campaign will meet its financial goal, and some families may struggle with the emotional weight of publicly asking for financial help. Additionally, fees from crowdfunding platforms can take a percentage of the funds raised, slightly reducing the amount received.

Outside of online fundraising, direct community support remains a time-tested way to handle funeral costs. Religious organizations, local charities, and even workplace contributions can play a role in easing the financial burden. Many churches and community centers have emergency funds or donation programs to help families in need. Some funeral homes even offer financial assistance or payment plans for those struggling to afford services.

Can I Name a Funeral Home as My Beneficiary?

No, you generally can’t name a funeral home as your life insurance beneficiary. Life insurance companies require beneficiaries to be individuals, trusts, or legal entities like estates, not businesses offering services. That’s because the purpose of life insurance is to provide financial support to your loved ones, not directly pay off service providers. However, you can work around this by setting up a funeral trust, assigning a payable-on-death (POD) account, or making arrangements with your family to guarantee the insurance payout is used for funeral expenses. Some states allow funeral assignments, where a portion of the life insurance payout goes directly to the funeral home before the remaining balance is given to the beneficiaries, but this depends on the insurer’s policies.

What Happens if My Life Insurance Payout Isn’t Enough for Funeral Costs?

If your life insurance payout falls short, your family will need to cover the remaining costs through other means: savings, credit, or take out a personal loan to cover the difference. To avoid this issue, it’s important to calculate potential funeral expenses ahead of time and make sure your life insurance policy provides sufficient coverage. If necessary, a supplemental burial insurance policy can help bridge the gap without adding financial pressure to your family.

How Long Does It Take for Beneficiaries to Receive the Payout?

The timeline for a life insurance payout varies, but in most cases, beneficiaries receive the money within two weeks to two months after filing a claim. Delays happen if there are disputes, missing documents, or if the policyholder passes away under suspicious circumstances requiring further investigation. Most insurance companies require a death certificate, claim forms, and proof of identity before processing the payment. If the policyholder had the plan for less than two years, the insurer might conduct a more detailed review to rule out fraud or misrepresentation.

To speed up the process, beneficiaries should promptly submit all required paperwork and work with an insurance agent if needed. While waiting for the payout, families may need to cover funeral expenses out of pocket or use a funeral financing plan.

Can My Family Use Life Insurance Money for Things Other Than Funeral Costs?

Absolutely. Once the life insurance payout is received, the beneficiary has full control over how the money is used. While many people use it to cover funeral expenses, it’s not legally required. Families often use the funds for outstanding medical bills, mortgage payments, daily living costs, or even setting up a savings account for future needs. The flexibility is one of the main advantages of life insurance compared to prepaid funeral plans, which are restricted to funeral-related costs.

Is Burial Insurance Worth It if I Already Have Life Insurance?

Burial insurance can be beneficial if your life insurance policy isn’t large enough to comfortably cover funeral costs or if you want a dedicated policy for end-of-life expenses. They also have looser underwriting requirements, making them easier to obtain for seniors or individuals with health issues. However, if your life insurance policy is already substantial and your beneficiaries are financially responsible, a separate burial policy may not be necessary. Instead, you can make sure your primary policy’s coverage is sufficient, or set aside a portion of savings in a payable-on-death account to handle funeral costs directly.