Losing a loved one is tough enough without the added financial burden of funeral expenses. From caskets to memorial services, costs can quickly add up, leaving families wondering if there’s any financial relief available. One of the most common questions people ask is: Are funeral expenses tax deductible?

The short answer? For most individuals, no. The IRS does not allow deductions for personal funeral costs. However, there are a few exceptions, especially for estates that meet specific criteria. If the estate is large enough to file a federal estate tax return, funeral expenses might be deductible as part of estate administration costs. But the rules are strict, and the IRS isn’t handing out tax breaks for every funeral.

This is where things get tricky. Understanding tax laws is already complicated, and when emotions are involved, it’s easy to overlook potential opportunities. In this guide, we break down everything you need to know: who qualifies, what expenses might be deductible, and how to make sure you’re following the law.

If you’re handling the financial aspects of a funeral, don’t make assumptions. A mistake could cost you. Keep reading to learn exactly how funeral expenses fit into the tax equation, and what steps you can take to avoid missing out on legitimate deductions.

Are Funeral Expenses Tax Deductible for Individuals?

No, the IRS does not allow individuals to deduct funeral expenses on their personal income tax return. It doesn’t matter how much you spent, how essential the costs were, or if they caused financial strain; funeral costs are classified as personal expenses, and personal expenses are never tax-deductible.

Let’s put it this way: the IRS sees funeral expenses the same way it views wedding costs, birthday parties, or vacations. It’s a personal choice, a life event; not a business or medical expense. That means no matter how much you spend on the funeral, it won’t lower your taxable income.

To be clear, here are some of the most common funeral costs that you cannot deduct:

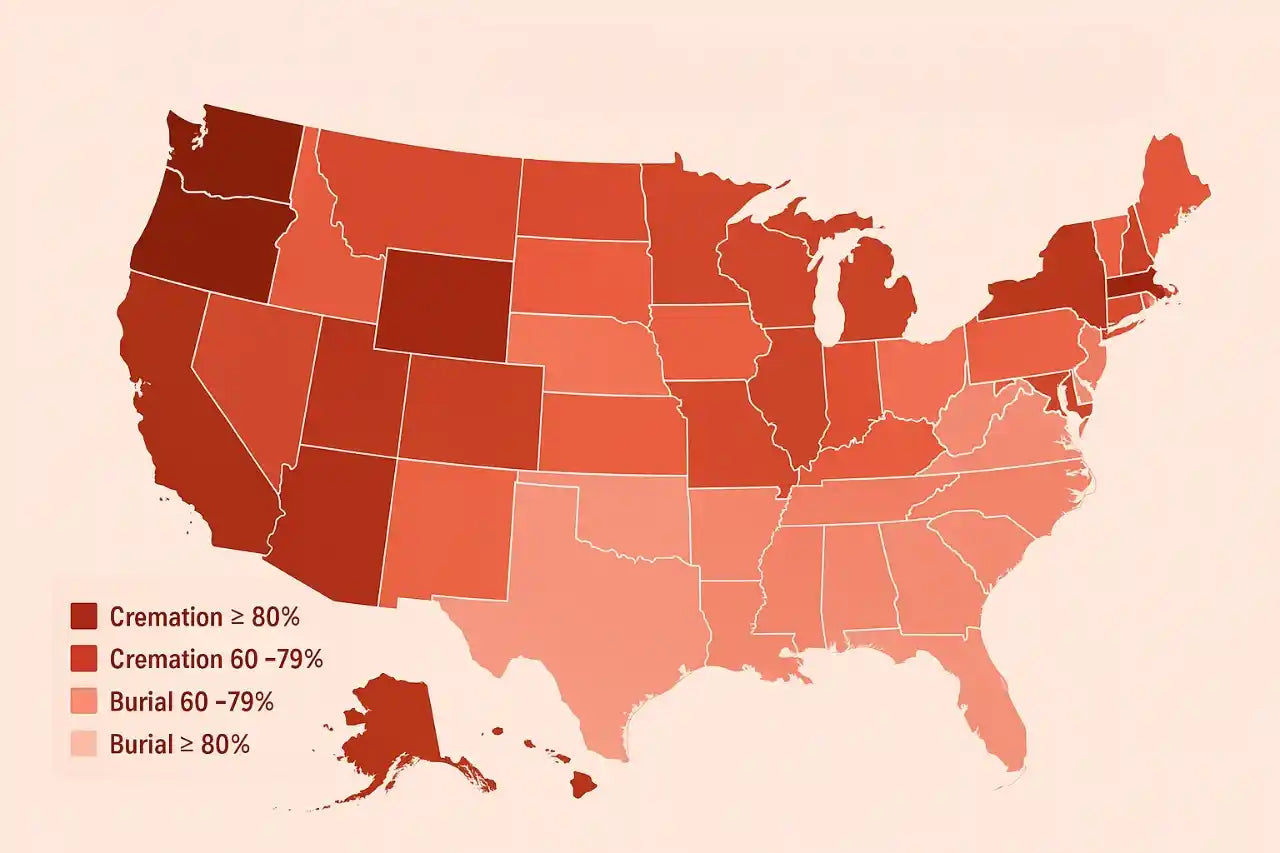

Casket or Urn Costs – Whether you choose a traditional burial or cremation, the costs of the container holding the remains are not deductible.

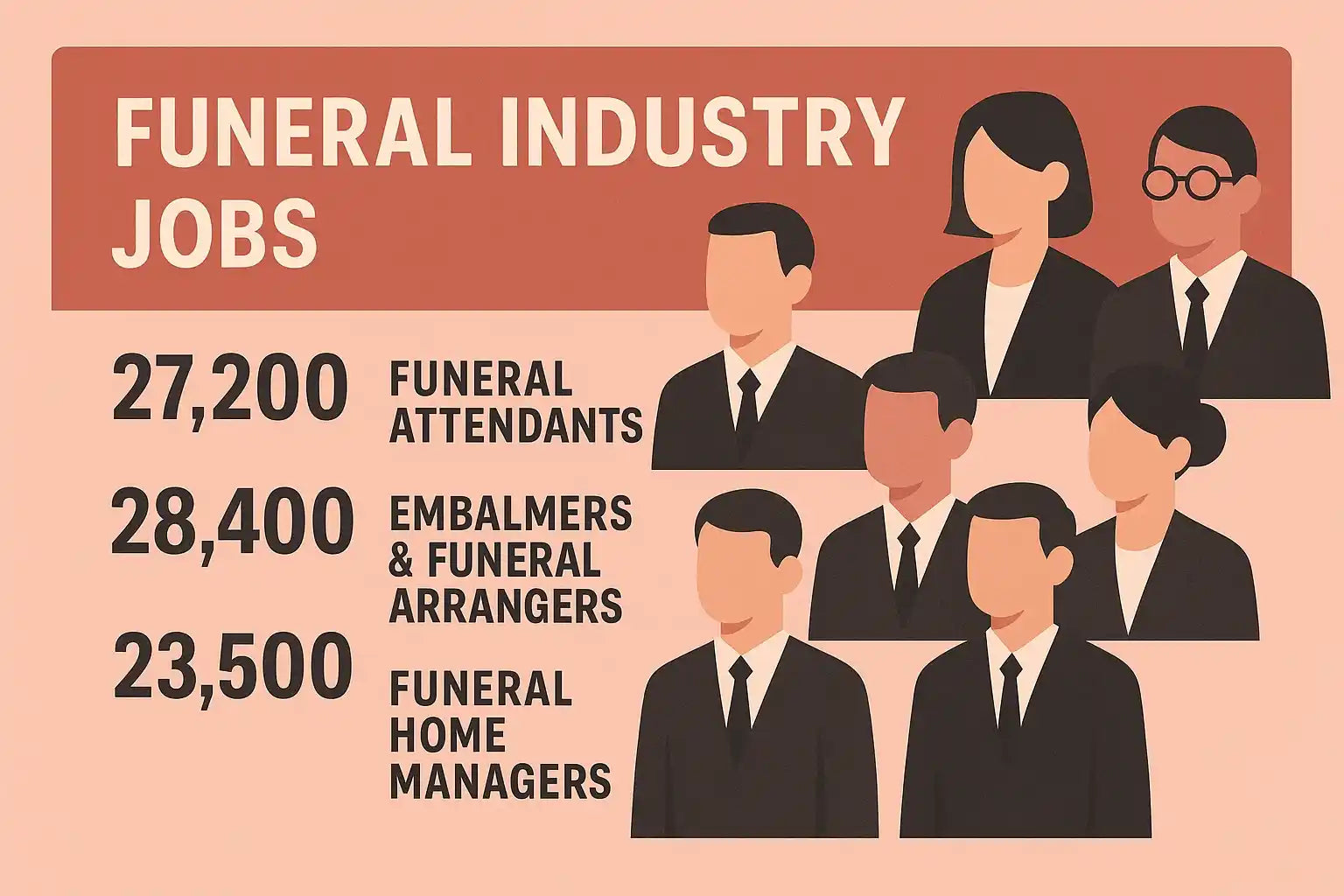

Funeral Home Services – The expenses for preparing the body, embalming, and hosting the ceremony at a funeral home are all personal costs.

Burial Plot or Cremation Fees – Purchasing a grave, headstone costs, or paying for cremation services are all out-of-pocket expenses, not deductible.

Transportation – The cost of moving the body from a hospital or home to the funeral home, hearse rentals, and even travel expenses for family members are not deductible.

Flowers, Programs, and Catering – The memorial service and its associated costs: floral arrangements, printed materials, and food for guests fall into the same non-deductible category.

Obituary Costs – If you pay to publish an obituary in a newspaper or online, that expense is entirely personal.

Some people assume that if they paid for a parent’s or spouse’s funeral, they might get a deduction. That’s not the case. Even if you used your own money to cover the costs, you cannot claim a tax break. The IRS simply does not make exceptions for individual taxpayers.

When Are Funeral Expenses Tax Deductible?

There’s one major exception: Estate Tax Deductions. This only applies in very specific situations, but if it does, it can significantly reduce the taxable value of an estate. Let’s break it down.

If the deceased’s estate (not family, not friends) pays for the funeral expenses and the estate is large enough to be subject to federal estate tax, then those expenses can be deducted. This means they lower the total taxable value of the estate before the IRS applies estate tax.

The Three Conditions That Must Be Met:

The costs must come from the estate’s assets, not from family members or other individuals. If someone else covers the bill, there’s no deduction; end of story.

Next, the estate must be large enough to owe federal estate tax. In 2024, the estate tax exemption is $13.61 million. This means if the estate is worth less than this amount, no estate tax applies, and there’s no deduction. If it’s worth more, the deduction comes into play.

The estate must file IRS Form 706. This is the United States Estate Tax Return, which is only required if the estate is above the exemption threshold. It’s the form where funeral expenses get deducted.

Example

Let’s say someone passes away, leaving an estate worth $15 million. Their funeral expenses total $20,000, and these costs are paid directly from the estate’s assets.

Without the deduction, the taxable estate remains at $15 million, which is $1.39 million over the exemption limit ($13.61 million). The portion above the exemption is subject to federal estate tax, which can be as high as 40%.

But because funeral expenses are deductible in this case, the estate can subtract $20,000, reducing its taxable value to $14.98 million. This saves the estate thousands of dollars in taxes, depending on the rate applied.

For most families, this deduction is irrelevant because their estates fall under the $13.61 million exemption. But for high-net-worth individuals, every deduction counts when minimizing estate taxes. Even a small funeral expense deduction can mean tens of thousands of dollars in savings.

What About State-Level Estate Taxes?

Some states have their own estate or inheritance taxes with lower exemption thresholds than the federal level. In those cases, similar deductions may apply at the state level, but rules vary. Always check with a tax professional if the estate is close to the taxable range.

Can Funeral Expenses Be Deducted on Business Taxes?

The short answer? Almost never. But let’s dig into the rare exceptions.

The most plausible scenario is when a company pays for an employee’s funeral due to a direct business interest. This usually applies to high-level executives, founders, or employees whose passing has a tangible impact on the business itself. In these cases, the funeral costs might be categorized as a business expense under IRS rules, but only if the business can justify that the expense is directly related to company interests.

Some examples of where this has happened:

Honoring a Key Executive or Founder – If a company covers funeral costs to honor a CEO, business partner, or critical executive whose contributions were significant to the company’s success, there’s a chance it could be deducted as an ordinary and necessary business expense. This is rare, but it has been seen in industries where company leaders have an outsized impact on brand reputation or business continuity.

Company-Sponsored Memorial Services – A business may organize and fund a memorial event for an employee or executive, especially if their role is integral to business operations. In some cases, expenses tied to such events may be considered business-related, particularly if they involve client relations, shareholder engagement, or internal company morale.

Death Benefit Agreements – If a company has a formal policy (such as a contractual death benefit agreement) stating that it will pay for funeral expenses of certain employees, those costs might be deductible as part of employee benefits. However, this is an extremely niche tax situation that requires clear documentation and tax professional guidance.

However, even in these edge cases, the IRS is strict about what qualifies as a business deduction. The business must prove that the expense is ordinary, necessary, and directly tied to business operations. In most instances, simply wanting to “honor” an employee does not justify a tax deduction. If the IRS sees the expense as a personal or goodwill gesture, it will be denied.

Alternatives to Funeral Expense Deductions

Since funeral costs are not tax-deductible, individuals need to explore other financial strategies to ease the burden. Fortunately, several options can help cover these expenses without dipping into personal savings or going into debt. Let’s break down the most effective alternatives.

Life Insurance: A Reliable Safety Net

Life insurance is one of the most common ways to cover funeral expenses. Many standard life insurance policies pay out a lump sum to beneficiaries, which can be used for any purpose, including burial costs. However, for those specifically looking for a policy to handle funeral expenses, there are two primary options:

Final Expense Insurance (Burial Insurance): These policies are specifically designed to cover funeral costs, cremation, or other end-of-life expenses. They typically offer lower coverage amounts, ranging from $5,000 to $50,000, and are easier to qualify for compared to traditional life insurance.

Traditional Life Insurance: While not funeral-specific, a standard term or whole life insurance policy can provide a more significant financial cushion that covers not just the funeral but also outstanding debts, estate taxes, and financial support for dependents.

It’s essential to make sure that beneficiaries understand the policy and have immediate access to the funds upon passing, otherwise, delays in claims processing could leave loved ones struggling to cover the funeral bill upfront.

Prepaid Funeral Plans

Prepaid funeral plans allow individuals to arrange and pay for funeral services in advance. The biggest advantage? Prices are locked in, avoiding inflation-driven cost increases. However, these plans can be restrictive and may not always be transferable if a person moves to a different state or chooses a different funeral provider.

There are two main types of prepaid funeral arrangements:

-

Revocable Prepaid Funeral Plans: The purchaser retains control over the funds and can request a refund if circumstances change.

-

Irrevocable Prepaid Funeral Plans: These are typically used for Medicaid planning, ensuring that assets are spent down to meet Medicaid eligibility requirements. However, once purchased, these plans cannot be canceled or refunded.

Each state regulates prepaid funeral plans differently, so it’s important to research whether the funeral home places the funds in a trust or insurance policy that protects them in case the provider goes out of business.

(HSAs) & (FSAs)

You can not use HSAs and FSAs for funeral expenses directly but they can reduce the financial burden by covering end-of-life medical costs, hospice care, and other healthcare expenses, allowing families to preserve other savings for funeral-related costs.

HSAs (Health Savings Accounts): Available to individuals with high-deductible health plans, HSAs allow tax-free contributions and withdrawals for qualified medical expenses. Since funeral costs don’t qualify, these accounts are best used to cover unpaid hospital bills, long-term care, and hospice care before death.

FSAs (Flexible Spending Accounts): These employer-sponsored accounts function similarly to HSAs but must be used within the plan year. Again, while funeral expenses are excluded, FSAs can help with medical expenses leading up to death, ensuring more funds remain available for final arrangements.

Veterans Burial Benefits

For eligible veterans, the Department of Veterans Affairs (VA) provides a range of burial benefits that can significantly reduce or eliminate funeral costs:

Burial Allowance: The VA provides tax-free reimbursement to surviving family members to help cover burial and funeral expenses. The amount varies depending on service history and whether the death was service-related.

Free Burial in a National Cemetery: Veterans, their spouses, and dependents may qualify for burial in a national cemetery at no cost, including a gravesite, headstone, and perpetual care.

Reimbursement for Private Burial: If the family opts for a private burial, the VA may provide a partial reimbursement for funeral and transportation costs.

Families of veterans should apply for these benefits as soon as possible, as reimbursement is not automatic and requires documentation.

State-Specific Funeral Assistance Programs

Some states offer funeral assistance programs for low-income families, providing direct financial aid or subsidized burial services. These programs vary significantly in eligibility requirements and funding amounts.

-

Medicaid Funeral Assistance: In some states, Medicaid allows a portion of a recipient’s assets to be set aside for funeral expenses without affecting eligibility.

-

Local and State Grants: Many counties and municipalities have emergency burial assistance for those who pass away without funds or family support.

-

Social Security Death Benefit: While the Social Security Administration (SSA) offers a one-time payment of $255 to surviving spouses or dependents, this amount is minimal and won’t cover the full cost of a funeral.

Since funding for these programs fluctuates, it’s essential to check local regulations and availability before relying on state assistance.

Can I Deduct Funeral Travel Expenses?

No, funeral travel expenses are not tax-deductible. The IRS doesn’t consider funeral costs, whether for services, burial, or related travel, as qualified deductions. Even if you travel across the country to attend a funeral, those expenses are personal and can’t be written off. The only exception? If you're managing the estate and must travel solely for estate-related duties, some expenses might be deductible as part of estate administration costs, but even that’s rare. Bottom line? If you’re hoping to offset flights, hotels, or mileage for attending a funeral, the IRS won’t cut you any slack.

Conclusion & Final Words

Funeral expenses are not tax-deductible for individuals. No matter how necessary or costly they may be, the IRS does not allow you to claim them as personal deductions. The only exception applies to estates; if the estate is large enough to file a federal tax return, funeral costs can sometimes be deducted from the estate’s taxable value. But for the average taxpayer, there’s no financial relief through deductions.

This reality often surprises people, especially when they’re managing the overwhelming costs of a funeral. That’s why proper financial planning is essential. If you’re looking for ways to ease the burden, consider options like pre-need funeral plans, life insurance, or even small business deductions if the expenses are tied to an owned business (though that’s rare).

Remember, funeral costs are a personal responsibility, and the IRS treats them as such. Understanding this upfront can save you time, frustration, and false hope when tax season rolls around. If in doubt, consult a tax professional to explore whether your unique situation presents any legal workarounds.