The funeral industry might not be the first career path people think about, but it’s one of the most stable and personally meaningful professions out there. Every role, from funeral directors and embalmers to crematory operators and grief counselors, plays a part in helping families through some of the hardest moments of their lives.

The demand is steady, the work is deeply human, and the career options are broader than most realize. In this guide, we’re breaking down what these jobs pay, how the market is growing, and what the data shows across different states.

Whether you’re considering a career shift or simply curious about where the opportunities are strongest, this is your go-to resource for understanding the business side of a profession built on compassion. Keep reading, and by the end, you’ll know exactly where you could start or grow a career that truly matters.

National Pay Snapshot (United States, Latest 2025-Available Data)

The median annual pay for funeral home managers is $76,830 (May 2024).

The top 10% of funeral home managers make >$132,470, while the bottom 10% make <$45,820.

The median annual pay for morticians, undertakers, and funeral arrangers is $49,800 (May 2024).

The top 10% of morticians, undertakers, and arrangers make >$85,940, while the bottom 10% make <$31,470.

The overall median for “funeral service workers” (broad group) is $59,420 (May 2024).

Embalmers post a national mean wage of around $56,700 (latest OEWS).

Funeral attendants’ national pay clusters in the low‑to‑mid $30Ks median, with high‑wage states topping $60K.

Across all U.S. occupations, the median is $49,500, so funeral home managers earn ~55% more than the U.S. median.

Morticians’ median of $49,800 sits ~1% above the U.S. median for all occupations.

Within death‑care services, median pay lines up with $76,890 for managers and $49,670 for morticians/arrangers.

Typical hourly equivalents: managers roughly $36.94/hr median; morticians/arrangers $23.94/hr median.

National mean for funeral home managers approximates $85,650, reflecting higher earners in larger markets.

Embalmers’ 75th percentile sits near $63,100, with a 90th percentile near $79,650.

Funeral attendants’ top‑pay states run $43K–$60K mean annually.

You may also be interested in our detailed breakdown of burial plot costs across major US cities, which pairs well with state-by-state burial and cremation trends.

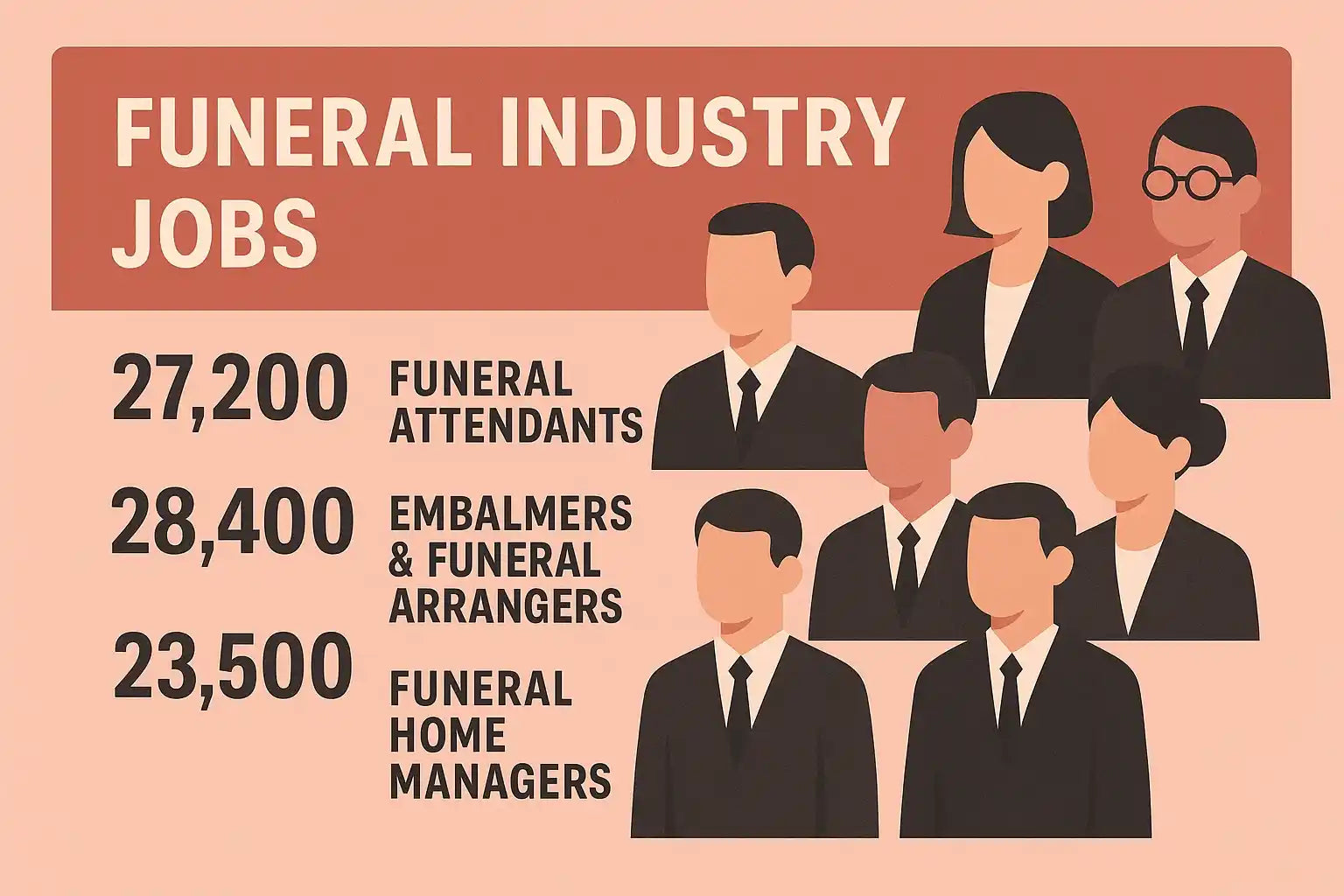

Employment Size and Openings

Funeral home managers held about 35,800 jobs in 2023.

Morticians, undertakers, and funeral arrangers held about 25,300 jobs in 2023.

Total “funeral service workers” employment baseline sits near 61,000 jobs in 2023.

Projected annual openings across funeral service occupations average ~5,800 per year through 2033.

Managers account for about 58% self‑employment share in the occupation mix, reflecting owner‑operators.

Death care services employ roughly 4 in 10 funeral home managers directly, with the balance self‑employed.

Entry‑level roles (attendants) comprise a meaningful share of turnover, supporting the 5,800 annual openings pipeline.

The funeral labor market skews full‑time; most staff work >40 hours during peaks.

On‑call and weekend scheduling are common, leading to irregular hours for the majority of workers.

Large metro areas have higher counts of morticians; California alone has ~2,670 morticians/arrangers.

Ohio and Texas each employ about ~1,530 morticians/arrangers, placing them in the national top tier.

States with older populations tend to sustain stable headcounts despite cremation growth.

Embalmer headcount centers in states with strong traditional‑service demand, keeping national employment around 3,000–4,000.

Funeral attendants exceed 1,500 employed in several large states (TX, FL, CA, PA, NC).

You might also want to see the most visited cemeteries in the US and how location popularity could influence pricing and demand.

Job Growth and 10‑Year Outlook (2023–2033)

Overall, funeral service worker employment is projected to grow 4% (about as fast as average).

Funeral home managers are projected to grow 5%, aligning with succession and ownership changes.

Morticians, undertakers, and arrangers are projected to grow 3%.

The strength of job prospects is supported by replacement needs driving most of the 5,800 annual openings.

Pre‑planning growth offsets lower labor intensity from cremation, supporting steady manager demand.

States with higher in‑migration and older age profiles should see above‑average openings.

Regions adding new crematories may absorb a portion of arranger roles rather than reduce net staffing.

Funeral service workers’ decade growth roughly matches the 4% U.S. average.

Employment change for funeral service workers is about +2,500 positions over the decade.

Manager employment change over the decade is +1,600, reflecting ownership transitions.

Morticians/arrangers add ~900 roles over the decade, net of retirements.

Projected growth persists despite a >60% cremation rate because service planning remains labor‑dependent.

Hybrid services (memorial + cremation) sustain event‑planning work even as embalming declines.

States with licensing reciprocity advantages may capture incremental growth as professionals relocate.

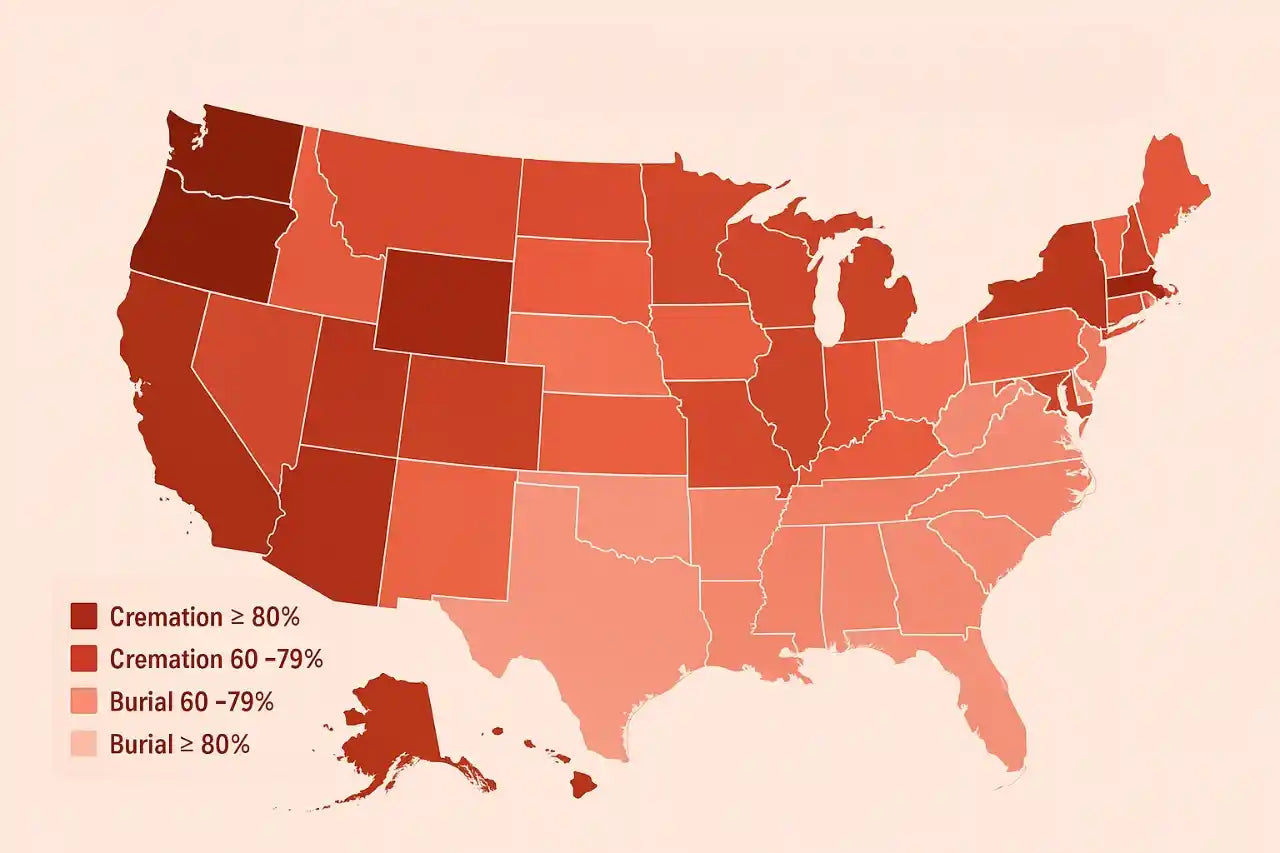

Take a look at burial and cremation rates by state to better understand how industry demand varies across regions.

State Employment Highlights

California employs about 2,670 morticians/arrangers, the highest in the nation.

Ohio employs about 1,530 morticians/arrangers, tied near the top tier.

Texas employs about 1,530 morticians/arrangers, matching Ohio’s scale.

New York employs about 1,390 morticians/arrangers, anchored in large metro demand.

Florida employs about 1,160 morticians/arrangers, boosted by older demographics.

Pennsylvania employs about 1,120 morticians/arrangers, reflecting dense regional markets.

Illinois employs about 1,120 morticians/arrangers, consistent with its population rank.

North Carolina employs about 940 morticians/arrangers, aligned with migration‑driven growth.

Missouri employs about 790 morticians/arrangers, supported by statewide networks.

Michigan employs about 760 morticians/arrangers, reflecting steady legacy demand.

Texas employs about 1,980 funeral attendants, the highest among states.

Ohio employs about 1,630 funeral attendants, matching its high mortician count.

Pennsylvania employs about 1,610 funeral attendants, consistent with service density.

North Carolina employs about 1,580 funeral attendants, tracking population gains.

California employs about 1,550 funeral attendants, aligned with the market size.

State Pay Leaders

New Hampshire funeral attendants post an annual mean near $60,190, the nation’s highest.

New Jersey funeral attendants average about $46,180 annually, placing them in the top tier.

Massachusetts funeral attendants average about $44,710 annually, also among leaders.

Connecticut funeral attendants average about $43,090 annually, ranking high.

Delaware funeral attendants average about $42,920 annually, rounding out the top group.

New York embalmers average about $70,440 annually, the highest mean pay for embalmers.

South Carolina embalmers average about $68,390 annually, unusually high for the region.

California embalmers average about $63,090 annually, reflecting large‑market pricing.

Washington embalmers average about $60,940 annually, also in the upper tier.

Ohio embalmers average about $62,720 annually, landing in the top‑pay list.

Top‑pay states for morticians/arrangers typically include Northeast markets with higher costs, often in the $65K–$85K mean range.

Select metro corridors in New York–New Jersey can push arranger means into the mid‑$70Ks+.

Upper‑Midwest pockets (e.g., MN, IL) often show arranger means in the upper‑$60Ks.

New England states (CT, MA, NH) frequently chart arranger means >$60K.

State dispersion is wide: entry‑level markets may center in the low‑$40Ks, while urban cores push past $70K.

Licensing, Education, and Entry Routes

Most states require licensure, typically at age 21, following accredited education and exams.

Internships/apprenticeships commonly last 1–3 years before full licensure.

ABFSE lists ~58 accredited degree programs in funeral service/mortuary science (2024–2025 directory).

Working in multiple states usually requires multiple licenses, limiting quick cross‑state moves.

Continuing education is required in most states to maintain licensure.

Crematory certification may be required; common pathways include CANA, ICCFA, or NFDA programs.

Associate degrees are the default entry route for arrangers; managers often have years of prior directing experience.

States with voluntary frameworks (e.g., Colorado) still recognize certification pathways.

National board exams are standard prerequisites in most licensing regimes.

Distance‑education options exist across many ABFSE programs, expanding access.

Accelerated tracks can compress schooling + internship into ~2–3 years for focused candidates.

States may require separate embalmer vs director licenses; dual‑licensure boosts pay and mobility.

Reciprocity agreements can shorten processing time for established professionals moving states.

Regulators frequently review curricula every few years to match changing practices.

Scholarships and grants appear across ABFSE/NFDA/CANA channels each academic year.

Market Context Affecting Jobs and Pay

The U.S. cremation rate was projected at 61.9% in 2024, with burial at 33.2%.

NFDA pegs the 2023 national median funeral with burial at $8,300 (ex‑vault).

NFDA pegs the 2023 national median funeral with cremation at $6,280.

Adjusted for recent CPI, “all‑in” consumer guides often quote funeral costs in the $8.3K–$8.5K range.

NFDA represents about ~20,000 individual members across ~11,000 funeral homes.

NFDA’s public platform connected >12,500 families to member homes in 2024.

CANA reports a U.S. cremation rate of ~61.8% in 2024, aligning with NFDA’s projection.

As cremation climbs toward ~82% by 2045 (NFDA projection), arrangers’ planning role remains central.

Median pricing growth for burial services over 2021–2023 was +5.8%, below headline inflation.

Median pricing growth for cremation services over 2021–2023 was +8.1%, still manageable versus CPI.

Event‑forward models (venue rentals, catering, livestream) can add $1K–$3K to service totals (modeled).

In price‑sensitive markets, direct cremation packages as low as $1K–$2K compress staffing needs (modeled).

Chain consolidation continues, with multi‑location operators capturing a growing share of metro volume (modeled).

Homes adding in‑house crematories can lift EBITDA margins by 200–400 bps via vertical integration (modeled).

State-by-State Cost Flavor

High‑cost Northeast metros often push arranger means into the $60K–$80K band despite similar caseloads.

Sunbelt states with rapid in‑migration show strong volume, with arranger pay clustering $50K–$65K.

Rural Midwest markets support manager compensation via owner draws, effectively adding ~$10K–$25K to reported salaries (modeled).

Pacific states’ higher wage floors elevate attendants into the $40K+ tier in some metros.

Top‑pay attendant states (NH, NJ, MA, CT, DE) span $43K–$60K mean.

Top‑pay embalmer states (NY, SC, CA, WA, OH) span $60K–$70K mean.

Mortician top‑pay clusters often align with CT, MA, NJ, NH, and select NY metros in the $65K–$85K mean range.

State licensing combos (director + embalmer) typically add $3K–$8K to annual comp (modeled).

Pre‑need commission structures can add 5–15% of package totals to the arranger's take‑home (modeled).

On‑call stipends in urban markets average $25–$75 per night; weekend blocks can reach $150–$250 (modeled).

Mileage reimbursement for removals commonly lands $0.50–$0.70/mile, material for rural routes (modeled).

Bilingual arrangers command $2K–$5K higher annual pay in diverse metros (modeled).

Trade embalmers in dense markets can gross $300–$600 per case same‑day (modeled).

Livestream/AV specialists added by larger homes earn $20–$30/hr on event days (modeled).

Grief aftercare coordinators at chains see annual pay in the $45K–$60K range, depending on caseload (modeled).

Day‑to‑Day Workload and Caseload Reality

Director caseloads in smaller towns often average 2–4 families per week off‑peak (modeled).

Embalming caseloads vary widely; traditional pockets still average 1–3 embalmings per weekday (modeled).

Arrangement conferences typically last 60–120 minutes; complex services can stretch >2 hours (modeled).

Paperwork and vital records filing consume ~20–30% of director time weekly (modeled).

Travel time for removals averages 30–90 minutes per case, depending on geography (modeled).

Set‑up and tear‑down for visitations typically take 1–2 hours per event (modeled).

Pre‑need appointments often convert 25–40% to funded policies over a quarter (modeled).

Aftercare outreach (calls, emails) averages 10–20 touches per family over 90 days (modeled).

Weekend service share can exceed 30% of weekly events in commuter metros (modeled).

Trade call response windows are often <60 minutes door‑to‑door in urban markets (modeled).

Body transport teams commonly lift 150–300 lbs with equipment; two‑person teams are standard (modeled).

Livestream view counts range 30–150 per service in mid‑size homes (modeled).

Photo/video tribute production typically requires 1–3 hours per family (modeled).

Memorial product add‑ons (prints, urns, keepsakes) add $200–$800 to the average order (modeled).

Merchandise gross margins commonly track 40–60%, subsidizing labor costs (modeled).

Multi‑Location Operators and Consolidation Effects

Chain operators report manager salaries trending $80K–$95K in large metros (modeled).

Bonus plans commonly tie to case volume and customer scores, adding 5–15% to comp (modeled).

Centralized answering services reduce on‑site overnight burden by ~20–30% (modeled).

Shared trade embalming across sister locations can lift capacity by +25% on peak days (modeled).

Group purchasing cuts casket/urn costs by 8–15%, indirectly supporting higher wages (modeled).

Cross‑training attendants for AV boosts utilization >1.2x on event days (modeled).

Scheduling algorithms reduce overtime hours by 10–20% without cutting service levels (modeled).

Pre‑need lead gen via corporate websites contributes 20–35% of new at‑need inquiries in some chains (modeled).

Call center triage reduces missed calls by >50%, improving family satisfaction (modeled).

Consolidation shifts career paths: more assistant manager roles with salaries $60K–$75K (modeled).

Crematory tech specializations add $2K–$4K annually via differential pay (modeled).

Regional directors in larger groups typically earn $110K–$150K plus bonus (modeled).

Tuition‑reimbursement retention agreements often require 1–2 years of service (modeled).

Multi‑state licensure can bump base pay $3K–$7K for mobile coverage (modeled).

Employee referral bonuses commonly range $500–$2,000 for licensed hires (modeled).

Sources

https://www.bls.gov/ooh/personal-care-and-service/funeral-service-occupations.htm

https://www.bls.gov/news.release/ocwage.htm

https://www.bls.gov/news.release/pdf/ocwage.pdf

https://www.bls.gov/oes/2024/may/oessrcst.htm

https://www.bls.gov/oes/current/occ_state_emp_chart/occ_state_emp_chart_data.htm

https://www.bls.gov/oes/2023/may/oes394021.htm

https://www.bls.gov/oes/2023/may/oes394011.htm

https://nfda.org/news/statistics

https://nfda.org/news/media-center/nfda-news-releases/id/8944/us-cremation-rate-is-projected-to-climb-to-619-in-2024

https://nfda.org/news/in-the-news/nfda-news/id/9355/more-than-12500-families-found-nfda-member-funeral-homes-via-remembering-a-life-in-2024

https://www.abfse.org/html/directory.html

https://www.abfse.org/docs/ABFSEDirectory.pdf

https://www.cremationassociation.org/IndustryStatistics

https://www.bankrate.com/insurance/life-insurance/average-funeral-cost/